michigan sales tax exemption nonprofit

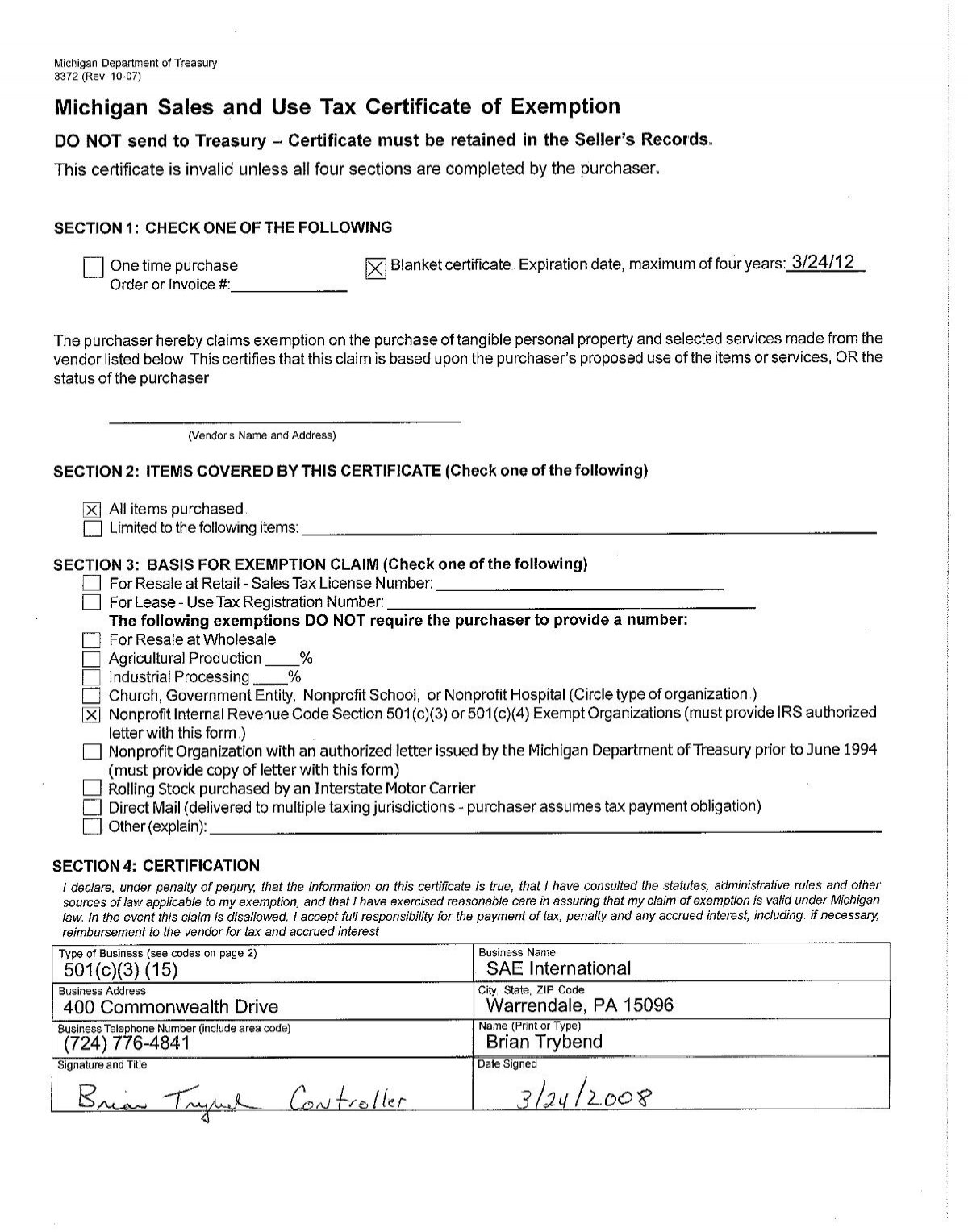

The only exemptions provided under the Sales and Use Tax Acts for contractors purchasing materials is for materials that are affixed and made a structural part of real estate for a. 501 c 3 and 501 c 4 Organizations 501 c 3 and 501 c 4 organizations must provide proof that they are.

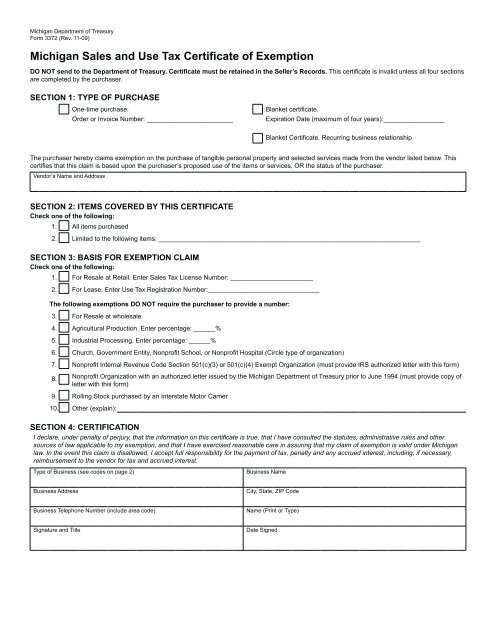

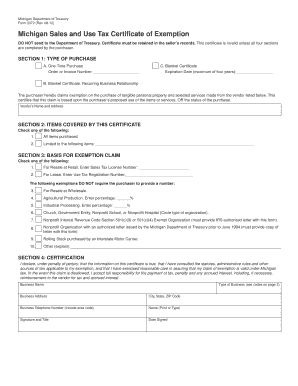

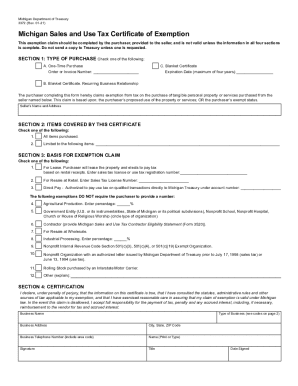

01-21 Michigan Sales and Use Tax Certificate of Exemption.

. But the one tax exemption that even nonprofits sometimes find. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Church Government Entity Nonprofit School or.

The following exemptions DO NOT require the purchaser to provide a number. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Enjoy flat rates with no-surprises.

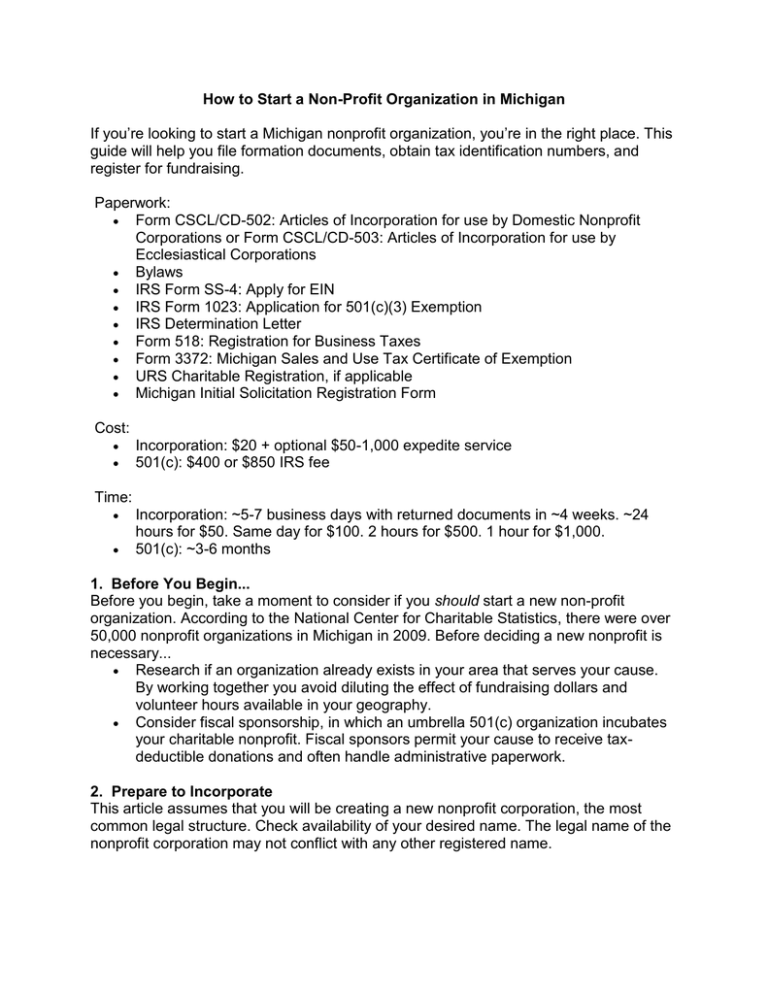

We never bill hourly unlike brick-and-mortar CPAs. Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process. Once your organization receives your 501c determination letter from the IRS it will automatically be.

Gretchen Whitmer got a years-long effort to exempt menstrual products from sales and use taxes over the finish line. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax. State income tax exemption.

Michigan Department of Treasury 3372 Rev. D Church Government Entity Nonprofit. The following exemptions DO NOT require the purchaser to provide a number.

Common Sales and Use Tax Exemptions and Requirements. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Apply for exemption from state taxes.

You will have to provide proof that your organization is Michigan non-profit. Michigan Department of Treasury Form 3372 Rev. Ad Make Sure Your Nonprofits Taxes Are Filed Correctly On-time.

There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to. Late last year Michigan lawmakers and Gov. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

Church Government Entity Nonprofit School or. Ad State Sales Tax Exemptions Same Day. Community Consulting Associates specialized in helping nonprofit organizations with government reporting and tax requirements research and writing projects financial management media.

The following exemptions DO NOT require the purchaser to provide a number. We never bill hourly unlike brick-and-mortar CPAs. 2022 Current Resources- State Sales Tax Exemptions.

Enjoy flat rates with no-surprises. We Ensure The Proper Procedures Policies Are In Place At Your Nonprofit Organization. This exemption claim should be completed by the purchaser provided to the seller.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fund Raisers - Licensing. Organizations exempted by statute. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

Michigan nonprofit animal shelters qualify for a sales tax exemption but they need to apply for the exemption annually. The exemption would cost the state about 100 million of. Certificate must be retained in the.

Mi Sales Tax Exemption Form Animart

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

How To Start A Nonprofit Step By Step

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Small Business Guide Truic

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Sales Tax License Michigan Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Fillable Online Michigan Form 3372 Fax Email Print Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller